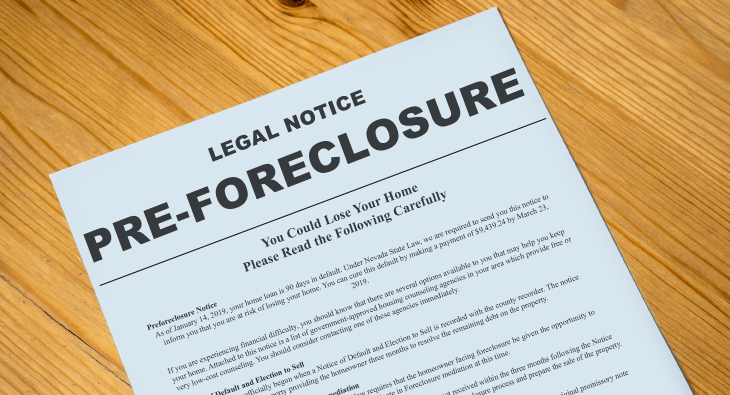

Are you confused about the foreclosure notice of default you received? Let us help clarify things for you.

Simply put, a foreclosure notice of default is a document filed by a lender to initiate the foreclosure process. This notice must be sent to anyone with an interest in the property, including other lenders and contractors who are owed money for their work. Additionally, the notice must be published in a newspaper and physically posted on the property.

While receiving this notice can be embarrassing, it serves as a crucial safeguard for consumers.

Prior to legislation mandating default notices, homeowners were at risk of losing their properties without warning. Foreclosures could proceed rapidly and stealthily, sometimes targeting the wrong homes by mistake.

Default notices provide an essential safeguard, alerting all parties with a stake in a property that foreclosure looms. They allow homeowners, in particular, a final opportunity to defend their rights before those rights are extinguished.

Homeowners in Birmingham have fallen victim to wrongful foreclosures, even in recent years, emphasizing the importance of this procedural protection. If you receive a default notice, time is of the essence. Act swiftly to avoid losing your home before you’ve had a chance to contest the foreclosure. Though foreclosures may still prove inevitable, default notices help ensure due process and minimize unfair surprise.

No matter where you live, stay vigilant. Know your rights, and defend them proactively. Default notices matter for all homeowners, and you should take action immediately.

Steps to Take If you Receive a Notice of Default

1. Stay Calm!

Losing your home to foreclosure is an incredibly stressful life event. The process that leads to foreclosure often unfolds over months or even years, intensifying the emotional toll. While the situation may seem dire, it’s critical to remain calm and think clearly. Panicking will only cloud your judgment and lead to poor decisions. Remain dedicated to researching and understanding your options so that you and your family can stay secure.

2. Educate Yourself

Stay informed – Educate yourself on the foreclosure process in your state. Be sure to understand the timeline of foreclosure in your state so you know when to have your affairs in order.

3. Gather Your Resources

Valuable resources abound for nonprofits and government organizations. As you establish your organization, be sure to seek guidance on the legal and tax requirements, which can be complex.

Trying to navigate it all alone is unwise. With expertise at your side, you’ll ensure your organization is set up properly from the start.

4. Know Your Options

If you’re facing foreclosure, take a deep breath—there are options that can help you keep your home or avoid a damaging foreclosure on your credit report. We specialize in finding solutions for homeowners in distress.

We are cash buyers, so we can quickly purchase your home, even if you owe more than it’s currently worth. We also facilitate short sales, allowing you to sell your property for less than the mortgage amount owed, with the lender’s approval. This can allow you to avoid a foreclosure while still relieving yourself of the mortgage debt.

In some cases, we can even help arrange a “rent-back” situation, where we purchase your home but allow you to remain as tenants. You can stay in your home, rebuild your credit, and possibly buy the home back in the future.

The point is, foreclosure is not the only option. There are ways to avoid losing your home, even in difficult financial circumstances. We have experience navigating many alternative solutions, and we’ll explore every option to find one that works for your unique situation. You don’t have to go through this alone—help is here.

We buy homes as-is in any neighborhood in the Birmingham, Hueytown, Hoover, Gardendale, Fultondale, Alabaster, Pelham, Calera, and Trussville, AL areas in cash.

Contact us today for a free offer on your home!